Not known Incorrect Statements About How Churches May Benefit from COVID-19 Relief's Employee

The Employee Retention Tax Credit Can be Filed in 2022 for 2021

Things about Sign the ERTC Letter by 6/1 - Common Good Vermont

Updates on the worker retention credit, Regularly Asked Questions on Tax Credits for Required Paid Leave and other details can be discovered on the Coronavirus page of Looking Ahead"If Congress continues to be concentrated on aiding companies through incentive programs, it will be essential for companies to keep track of the programs that can possibly benefit them," Johnson stated.

Financial Relief for Camps Beyond Paycheck Protection Program - American Camp Association

For example, there are paid-leave tax credits that have been extended and are offered through completion of September."While PPP funds have been tired, Smith added, several Small company Administration programs could make good sense for eligible services, such as the Shuttered Location Operators Grant program and Economic Injury Catastrophe Loans.

Some Known Factual Statements About Employee Retention Tax Credit - Justworks Help Center

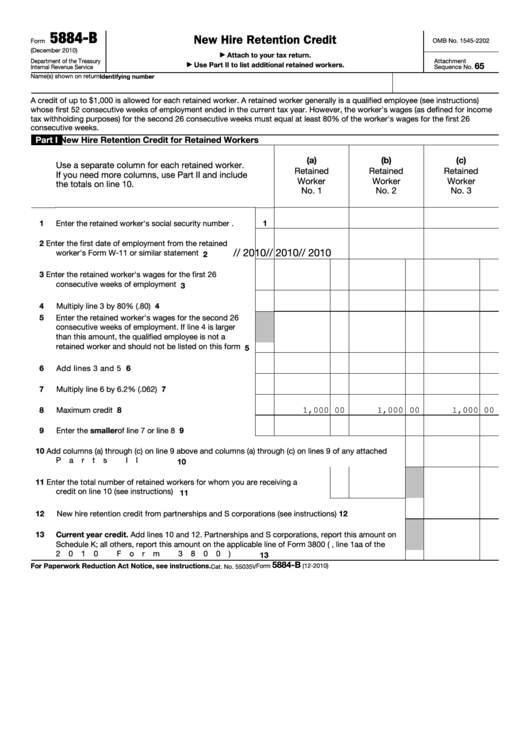

31 and Dec. 31, 2021Business tax filers will require additional payroll data and other paperwork to submit for the ERTC with their quarterly returns." Official Info Here are seeing a much quicker turnaround for clients who submit an initial Type 941 return with the ERTC credit included versus those clients that have us go back after the truth and submit an amended Form 941-X return to claim the credit," stated Jessica Hayes, director of finance for payroll, onboarding and business options business Accu, Pay HCM.

Hayes advised organization that may be eligible to claim the ERTC to take the following actions: Identify ASAP if the company's employees meet the ERTC criteria. Find all payroll information for the last couple of years. If a business can not identify eligibility or prepare the essential Kind 941s, reach out to a business services company.

ERC) Employee Retention Credit Processing Times - How Long To Get ERC Refund?

All About The Payroll Tax Credit and Other Stimulus Programs for

The Employee Retention Tax Credit (ERTC) is set to expire at the end of 2021, however that does not mean that businesses are out of time to take benefit of the credit. The precise details of the ERTC have actually altered since it was created by the Coronavirus Help, Relief and Economic Security (CARES) Act in March of 2020.